Why you should not be afraid to invest in private companies

The cyclical nature of the economy, the alternation of ups and downs of stock markets: how these processes affect public and private companies, explains Oleg Kuzmin, a leading analyst at Veligera Capital Fund.

THE REVERSE SIDE OF PUBLICITY

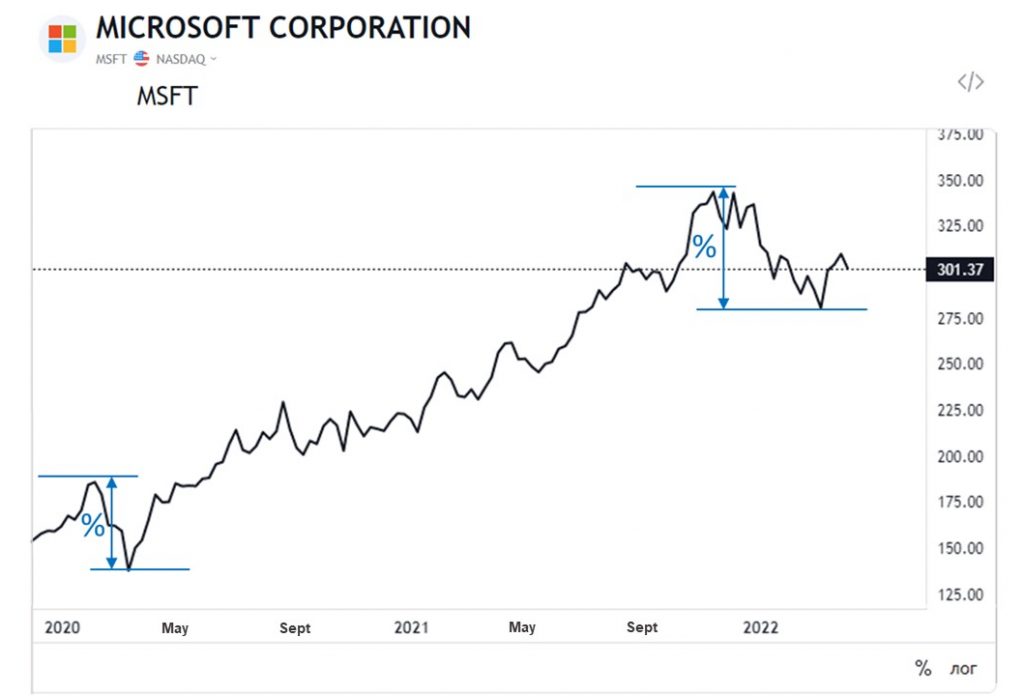

By making a decision to purchase shares of a public company, an investor plans that their value will grow as the business of the issuing company itself grows. But often, under the influence of the market situation, the investor has to adjust his expectations: stocks on the stock exchange go into negative territory. The reasons for the decline are not always related to changes in the financial performance of the company. The value of shares may go down due to a deterioration in market temper or a general correction – no matter how large and stable a company is, an irrational market will pull quotes down. As an example: shares of Apple, Microsoft, Google – from the point of view of the company’s business are growing, financial indicators for the reporting periods are good, however, their shares are experiencing declines against the background of the general market situation.

BUSINESS FIRST

Private high-risk companies experience periods of general decline differently. As long as the project remains private, it is not subject to such volatility as stock markets. At this stage, investors evaluate the business itself and its prospects more than the market situation. Where strong public companies adjust, weak ones can continue to grow. An excellent example is the developer of batteries for electric vehicles StoreDot, which shows a 2-fold increase in six months during a period of instability in the market. Many private companies have demonstrated an increase in estimates of the “covid period” after May 2020 in relation to the “pre-covid” 2019. Among these companies there are a platform for accepting Internet payments Checkout.com, German neobank N26 and Snyk which is working in the field of cybersecurity. The capitalization of these startups was growing comparable to the growth of the projects themselves at each round of financing.

Shares of private companies can also be priced at a discount when the entire market falls. The drawdown of a non-public fast-growing business with a fair valuation on the wave of panic and due to low liquidity can be noticeable, but short-term. Public companies of small capitalization fall much deeper and recover longer. Private companies and their investors are additionally protected by the fact that investors cannot immediately get rid of shares, succumbing to confusion. And it makes no sense to part with the shares of a promising company, applying an increased discount and realizing this.

IMPORTANCE OF THE MOMENT

Pre-IPO investments involve transactions with private companies that will enter the public market in the range of one to two years. What if, as soon as the startup becomes public, the market pulls it down with it? If company enters the stock exchange in the midst of a correction, such risk exist. It is counteracted by the fact that companies choose a favorable moment to exit, or postpone the placement and hold the next round, as StoreDot did this year. Conducting an additional round of financing allows you to avoid the current unfavorable conditions and at the same time raise the business valuation when there are reasons for it. It is possible to enter the stock exchange later, when investors return capital to investments again.

The market is cyclical: growth and fall replace each other. Once waited out the storm — entered the stock exchange through an IPO, or SPAC, or a direct listing. Wherein, the business of a private company continues to develop and will receive its assessment later.

The biggest risk for an investor with a well-chosen portfolio of private companies at the Pre-IPO stage is to hold securities longer than planned. The management of startups, current investors, bankers, underwriters, persons who bring companies to the public market are all interested in ensuring that the share price does not fall during the placement, but continues to grow and receives an even higher valuation.

Investing in carefully selected private companies 1-2 years before going public is a good opportunity to increase your investments without paying attention to the storm reigning in public markets.