Automation and Robotization of Processes will Spur the Growth of Insurance Business

The insurance market is a conservative one. A high degree of regulation, a commitment to proven solutions, and a lack of sufficient technical expertise have long held back the introduction of information technology in insurance. However, the COVID-19 pandemic and the accumulated technological advances have given digitalization a boost, making it critical. It is no longer possible to ignore today’s needs of society.

The insurance industry has stepped on the path of transformation: the automation and robotization of processes – InsurTech (Insurance Technology) – is actively gaining momentum

NEW CHALLENGES – NEW OPPORTUNITIES

A number of insurance market trends make the introduction of InsurTech inevitable:

- Growth of online sales, reduction of time for effective interaction with the client. Online insurance makes the purchase process simple and convenient and eliminates the need to personally visit an agent or company.

- The growing role of digital platforms for product promotion: online insurance services, marketplaces, the use of mobile apps.

- Customization of offers for a particular user, which requires the processing of a large amount of data.

- Increased requirements of market participants to the efficiency and speed of interaction between insurance companies, banks, brokers, and end customer.

- Increased interest of a young and tech-savvy audience in online insurance.

- Increased demands from users to simplify the processes of purchasing insurance and filing claims.

All of this has led to investment in InsurTech experiencing explosive growth. While the sector raised $1.12 billion between 1998 and 2018, funding reached $5.3 billion in Quarter 3 of 2021 (according to a Forrester Research report).

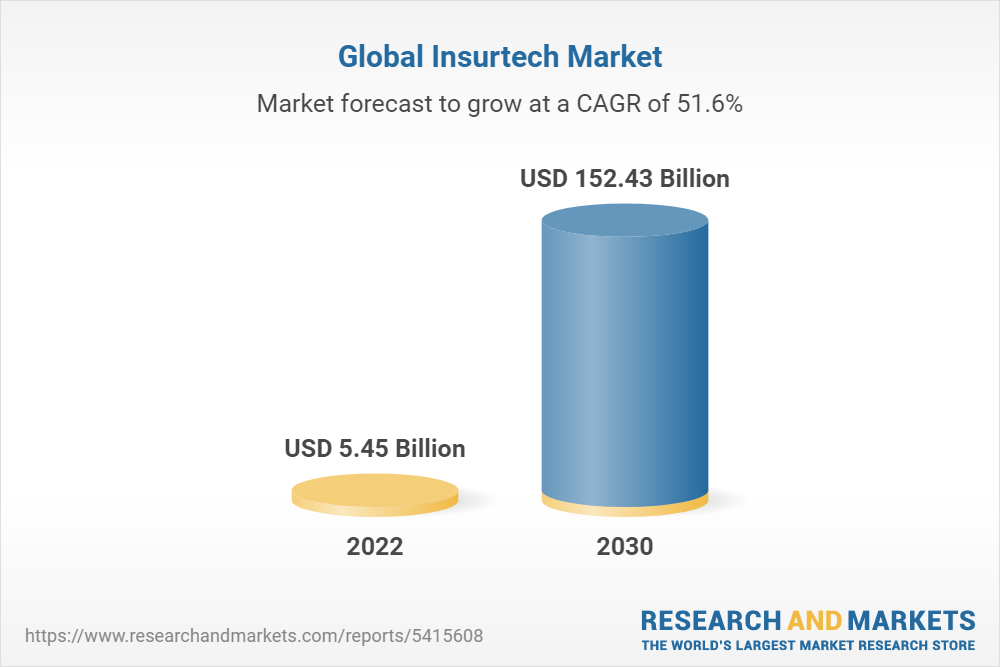

ResearchAndMarkets analysts predict that the global insurance technology market will reach $152.43 billion in 2030, with an average annual growth rate of 51.7% from 2022 to 2030.

Investments in InsurTech by large insurance companies and investment funds will be a factor in the growth of the insurance industry. Accenture analysts expect an increase in the global insurance market by $ 1.4 trillion from 2020 to 2025, including due to active introduction of technologies. Insurers’ revenue from online sales of digital products could reach $200 billion by 2025.

INSURTECH KEY TRENDS

In terms of working with customers, information technology allows insurers to reach a totally new level of distribution, successfully interacting with more and more demanding consumers. As far as internal processes are concerned, InsurTech makes it possible to organize seamless data exchange and a high degree of integration between insurers and service providers, to build a better risk assessment system, and to automate repetitive tasks.

Trends in InsurTech global market development are segmented by type, application, end-user and geographical location. Artificial intelligence, machine learning, automation, Internet of Things, video analytics, telematics, digital platforms, mobile apps, and other digital tools affect all the chains of insurance business organization.

We have identified the key trends of InsurTech.

- AI & Machine Learning. AI allows insurance companies to analyze consumer behavior and offer in-demand products through chatbots and voice assistants. The application of AI helps effectively model risks using large amounts of data, including about each customer individually. This approach allows you to calculate the cost of the final product, taking into account the needs of the user, to identify fraudulent actions, to exclude the influence of human factor on the efficiency of processes. AI-based software allows you to free up more than a third of the workforce. McKinsey estimates that the introduction of AI could increase insurance productivity and reduce operating costs by up to 40% by 2030.

- Automation of Business Processes. Modern technologies are used to robotize routine operations, reporting and analytics on the side of insurers. And customers see an increase in the ease of product selection and purchase.

- Internet of Things (IoT) and Built-In Insurance. The use of IoT technologies allows insurance companies to get more information about users not only post-facto, but also online. Special systems analyze the data obtained and use them, among other things, to prevent insurance events, notifying users of the high risk of an undesirable event. In some areas, the trend of buying goods with built-in insurance is gaining popularity. This is especially true for the real estate market and automotive business: users are spared the need to perform additional actions to protect their property.

- Blockchain. Distributed registry technology solves financial security issues. The use of blockchain allows you to monitor the security of transactions and avoid fraud through reinsurance by synchronizing the actions of market participants.

- Development of Digital Insurance Platforms. Competition for the customer is increasingly moving to marketplaces and online insurance platforms. Such services connect insurance companies, agents and end users, providing opportunities to increase sales and reduce costs.

To summarize, it’s no exaggeration to say that the insurance market is in a “digitalization race”: companies must master new technologies in order to succeed in the current environment. The stakes in this competition are high, but solid winnings await the winners.