Fintech Trends 2022

The past year 2021 has become a year of qualitative shift in the global economy and has set new vectors of development for the fintech market. The pandemic period and the changed social needs have led to a significant expansion of the use of technological solutions in the financial sector.

Investments in global fintech companies in 2021 amounted to $210 billion, which is 70% more than in the previous year. Such data is contained in the KPMG Pulse of Fintech report. Almost a quarter of these funds — $51.7 billion — came from companies developing payment technologies, and the cryptocurrency and blockchain technology sector set another record for the amount of funds raised. What other fintech trends will be dominant in the near future, we will tell you in our article.

NEOBANKING

A trend aimed at simplifying users’ access to financial services. To use banking products or make a financial transaction, you no longer need to go to the bank, it is enough to have Internet access. Neobanks provide services like traditional financial organizations, but work exclusively in the digital space.

Currently there are 256 non-banks operating in the world, and according to statistics, even more similar projects are under development. The current leader in the number of clients is the Brazilian neobank Nubank, which serves accounts of more than 30 million people. In the second half of 2021, Nubank held another round of financing, within which it attracted $1.1 billion for its development. At the same time, the American neobank Chime received investments in the amount of $750 million, and the capitalization of the project reached a record for the industry – $31 billion.

BLOCKCHAIN AND CRYPTOCURRENCIES

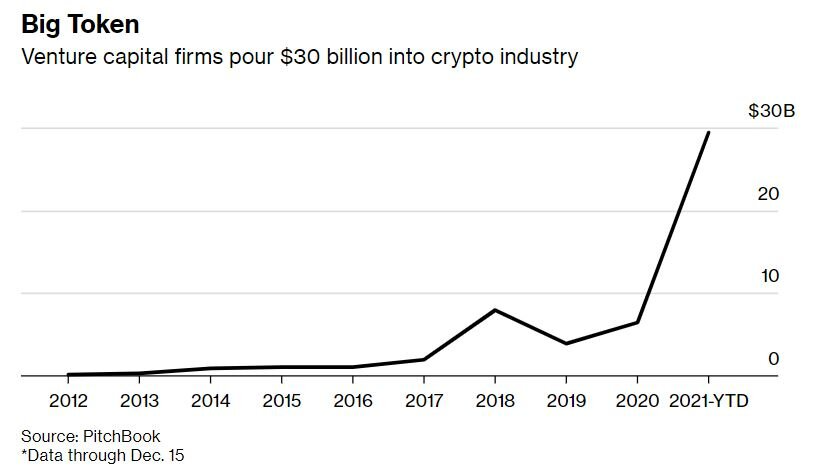

The cryptocurrency and blockchain sector attracted a record $30.2 billion by the end of 2021, three and a half times exceeding the previous maximum of $8.2 billion recorded in 2018. KPMG analysts interpret such investment activity as recognition of the importance of digital payment technologies in the development of financial systems of the future.

Decentralized finance allows you to create an open system of services that is accessible to every market participant and can work without the influence of government agencies. Users retain control over their crypto assets by interacting with the financial system through peer-to-peer, decentralized applications.

Increasing the transparency of interaction between market participants, the absence of intermediaries, reducing transaction time to a few seconds, the use of smart contracts for complex financial transactions are just a short list of advantages of using blockchain technologies.

The IPO of one of the largest crypto exchanges Coinbase in April 2021 became a landmark event in the financial world. Cryptocurrencies are becoming an asset that even the most conservative banking and government structures are forced to recognize.

BIG DATA

Big Data is the main tool in the work of financial organizations. Special algorithms process hundreds and thousands of sources, collecting information about customers. Structured data is used for statistics, analysis, forecasts and decision-making. However, most of the information collected is unrepresentative. A selective approach to data that takes into account user scenarios can improve the quality of analytics. To do this, fintech solutions that use synthetic data, audit information or specialize in processing certain types of data are being implemented.

IDC experts estimated that by 2021 the volume of the global Big Data and Business Intelligence (BDA) market reached $215.7 billion, an increase of 10% compared to the previous year. The calculations take into account commercial purchases of equipment, software and services related to BDA. About a third of BDA expenditures were in the banking sector, discrete manufacturing and professional services.

BIOMETRICS

Analysts note the growing use of biometrics technologies for users’ access to financial transactions. Along with the retinal pattern, fingerprints and features of the voice, researchers study how the client thinks, walks, and even breathes. Fingerprint Cards research says that by 2026, about 6 billion payment devices will be produced annually, and almost all of them will be contactless.

Consulting company Mordor Intelligence predicts annual growth of the global biometric payment card market by 155.5% in the period from 2021 to 2026. In absolute terms, the market volume will increase from $8.75 million to $1.69 billion by 2026.

The possibilities of financial technologies are limitless, and fintech startups are still one of the most attractive for investors – they receive every fifth dollar invested in technology industries. However, the wider the possibilities and applications of fintech solutions, the more difficult it is to separate what really are long-term trends from a short-term surge in popularity.