Results of Veligera portfolio companies 2022

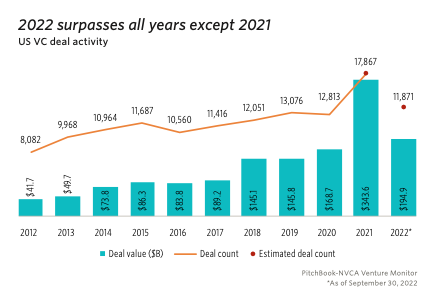

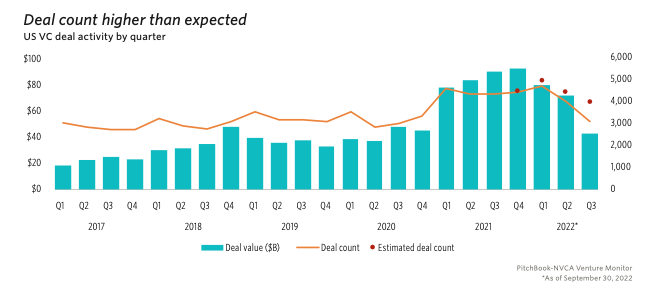

For the global private capital market, 2022 was a year of declining activity relative to the previous year. The changes in the global economy for sure affect the investment climate and forced investors to be more restrained and cautious in their assessments. During such periods, market volatility reaches a high level, and subjective factors come to the fore when dealing with private capital. In order not to succumb to the hysterical moods that can be seen in the secondary market, the experts of the Veligera Capital suggest evaluating non-public companies based on an analysis of prospects, fundamental processes, and business sustainability, objectively and with a cool head.

In this article, we have collected the most significant events of the outgoing year for Veligera Capital portfolio companies and voiced the expectations of the fund’s analysts for the coming 2023.

EATJUST, Inc

Results of 2022:

- In May 2022, Good Meat, a subsidiary of EatJust (a participation share of more than 70%) signed a contract with the manufacturer of biotechnological equipment ABEC Inc. for the construction of 10 bioreactors for growing meat. Bioreactors can potentially produce 13.7 thousand tons of beef and chicken annually. The company expects that the location of the reactors will be approved by the U.S. Food and Drug Administration in the near future. Such investments in production indicate that the company plans to significantly increase revenue.

- In June 2022, Good Meat, which has a unique technology for the production of meat synthesized at the cellular level, announced the start of construction of Asia’s largest cultured meat production complex. The launching is planned for the first quarter of 2023 in Singapore’s Bedok Food City. Alternative meat from Good Meat is already served in restaurants in Singapore, and the company itself is estimated at $ 1 billion.

- In August 2022, Eat Just attracted investments of $25 million by entering into a strategic partnership with the private investment company C2 Capital Partners, whose main investor is Alibaba Group. The Chinese retail leader will help EatJust to adapt to the local market, as well as increase sales of eggs and cultured meat to meet the needs of the world’s largest consumer of chicken eggs and chicken. This agreement opened up the Chinese market for EatJust. The company’s products are already being sold on the Tmall marketplace, owned by Alibaba Holding.

- The company actively creates collaborations for the production of joint products under the brands of partners whose products are sold in chain stores and catering chains, the most famous: being Walmart, Albertsons, Kroger, Burger King, and Starbucks. The slowdown in revenue growth that we observed in 2020-2021 due to disrupted supply chains and difficulties in interacting with suppliers due to covid restrictions is a thing of the past – sales growth in 2022 is returning to its previous pace. The popularity and acceptance of the product are actively promoted through cooperation with influencers and well-known media personalities. The size of the covered audience is constantly growing.

We expect that the main driver of EatJust’s growth in 2023 will be the markets of Indonesia and China, where it is planned to obtain regulatory approval for the production and sale of products from alternative eggs, and cultured meat. Revenue in the existing EatJust markets will continue to grow.

We believe that with the stabilization of the global market, the company’s valuation will recover and at the end of next year, perhaps another round of financing will be held or the company will enter an IPO.

THRASIO, LLC

Results of 2022:

- In the first half of the year, the company announced a change of management. Carlos Cashman, having vacated the position of CEO and retaining only a position on the board of directors, invited Greg Gili, a former executive director of Amazon and Airbnb, to lead the company. After joining Greg Greeley’s team, the company was optimized, which led to the dismissal of employees. Some shareholders of the company misinterpreted the facts of the dismissal of staff, which led to hysterical sales in the secondary market.

- Thrasio has integrated a multi-channel sales system, increasing its presence in retail chains.

- The company is increasing its presence in India, one of the fastest-growing markets.

- In the second half of the year, Thrasio updated a whole series of sales records, in particular, during the Amazon Prime Day, October Prime Day, Black Friday and Cyber Monday sales, the records of last year were broken.

- The company does not disclose its revenue, however, based on record sales during the landmark days for trading, it can be concluded that revenue is steadily growing.

- There have been no statements about Thrasio’s acquisitions of large companies in specialized sources and news for some time, however, according to the CEO, Thrasio is currently in the process of evaluating new deals, which means that very soon we will see new statements of the company about acquisitions.

We believe that the mass market will only grow and Thrasio will grow with it. Recently, the company estimated that one in three American households purchased some product under the Thrasio brand, while according to previous estimates, there were half as many such households. If the market stabilizes by the end of 2023, we expect Thrasio to restore the company’s valuation next year and launch an IPO in late 2023 — early 2024.

STOREDOTE, Ltd

Results of 2022:

- From the point of view of financing the company, the main events of 2022 were the delayed entry into the public market through SPAC and the holding of the next round of investment. At the same time, the round was estimated to be almost 2 times higher than the one according to which the Veligera Capital fund was part of the company in 2021. The current valuation of StoreDot is at the level of $ 1.2 billion, the company easily attracted this amount, which indicates the confidence of investors in the business. Having conducted the next round, the owners insured the value of the company against the volatility of the public market.

- The outgoing year of StoreDot was full of technological achievements:

– extremely fast charging has been demonstrated publicly;

– passed technical due diligence from Volvo;

– an expert assessment of the technology was obtained from the reputable independent battery laboratory Shmuel De-Leon Energy, which confirmed the prospects for successful commercialization of the development;

– the world’s only proven fast charging technology has been created without damage to the battery – 1000 cycles with a total capacity loss of no more than 20% with fast charging up to 80% in 10 minutes, which corresponds to a 200-mile run;

– prototypes of batteries capable of charging up to 100% in 10 minutes have been produced;

– StoreDot came close to mass production of batteries by sending pre-industrial samples to automakers (Volvo, Polestar, Daimler, BMW, Honda, GM, Hyundai, Porche, Ferrari, VinFast, Stellantis, Ola Electric, Draexlmaier). After testing on specific car models, the batteries will be finally adapted to them and prepared for commercial release.

- The development of StoreDot is strictly in accordance with the roadmap, the goal of which is to enter mass production by 2024. Eve Energy and Ola Electric are partners in battery production, and other manufacturers are also being considered to diversify supplies and optimize logistics.

When the market recovers, we can expect StoreDot to either enter the stock exchange through SPAC or conduct another round of financing. When this happens, in 2023 or 2024, will depend on the company’s need for additional capital.

SCOPELY, Inc

Results of 2022:

- Over the past year, the company has acquired and invested in 8 game studios (USA, Spain, UK, and India).

- Scopely regularly ranks high in reputable ratings of the gaming industry and stands next to companies such as Disney, Sony, Activision Blizzard, and Electronic Arts.

- The company is actively launching new projects, one of the latest was the Stumble Guys game with an audience of 20 million users per day.

- Marcy Wu, an IPO financial consultant who joined the team back in 2021, continues to work at Scopely.

- The company was profitable even before Veligera Capital entered it in 2021 and, judging by indirect signs, it is not slowing down.

- Scopely is a team that can not only make games but also sell them. This circumstance attracts the best studios and personnel from all over the world to it. Today, Scopely is a strong international company that does not cause any concern to investors.

In 2023, we expect Scopely to increase its valuation and launch an IPO or conduct a new round.

AUTOMATION ANYWHERE, Inc

Results of 2022:

- In December 2021, Automation Anywhere acquired the leading process detection and mining company FortressIQ.

- The market has revised the company’s valuation downwards, as well as its competitor, UiPath Inc.

- Gartner® Magic Quadrant™ in 2022 named Automation Anywhere the leader in RPA for the 4th year in a row.

- For the second year in a row, International Data Corporation (IDC) ranked Automation Anywhere first in terms of market share — 46% — among cloud RPA.

- The company received $200 million in debt financing from Silicon Valley Bank in the second half of 2022, which can be regarded as third-party expertise.

- At the moment, Automation Anywhere has not yet published information on revenue by the end of 2022, however, judging by the current growth rates, high expert estimates, and funds raised, we can expect revenue growth of 50% or more.

In 2023, we expect the company’s valuation to be restored. Automation Anywhere does not let go of its leading position in the RPA market, which continues to grow at a rate of about 30% per year.

XTRALIT, Ltd

Results of 2022:

- The company has the only technology in the world for extracting lithium from low-concentration sources. While competitors can extract from deposits with a saturation of more than 100 mg/l, Xtralit can receive lithium from 10 mg/l.

- Xtralit is conducting a funding round at a preliminary estimate of $40 million. In comparison with the round of 2021, the company’s valuation has increased by 2 times. At the end of the round, we expect an increase in the estimate.

- The company won a tender in Israel for the best technological solution for lithium mining, beating Lilac Solutions.

- A contract for lithium mining in the Dead Sea has been signed with one of the largest companies in Jordan, Manaseer Group. This circumstance significantly increases the attractiveness of the project, since the availability of mining sources is one of the main prerequisites for the commercial success of a startup.

- Xtralit received an Israeli state grant to create a pilot production. It is planned to launch pilot productions in Jordan and Israel.

- Studies have been conducted and working conditions are being discussed with Turkey, Argentina, Chile, the USA, Kazakhstan, and other countries.

In 2023, we expect the company to conduct another round of financing, and since the launch of pilot production in Jordan, a significant revaluation of the cost.

Afterword from the director, co-founder of the Veligera Foundation Dmitry Kartvelishvili, and the leading analyst of the Veligera Foundation Oleg Kuzmin

The private capital market primarily depends on the mood prevailing in the public market. If the public market is going through hard times, then IPOs often cannot be successful, and it becomes unjustified for companies to enter the stock exchange. As a result, initial placements practically stop until the market stabilizes.

A prolonged decline in the public market entails a decrease in the valuations of private companies, regardless of what business growth they demonstrate. The closer a company is to an IPO, the more pressure it is under due to the fall of public analogs. However, the reasons for the falls may be different: panic or lack of liquidity among investors, limited demand at the moment, and so on.

There is a very illustrative example of inadequate valuation on the market with the companies EatJust and Good Meat, we recall that the latter is 70% owned by EatJust. In the secondary market, there are offers of EatJust shares at an estimate below $ 500 million, while in the rounds, the valuation of only Good Meat is more than $1 billion and it cannot be ignored. The reasons for the falls mentioned above have nothing to do with fundamental factors and metrics of companies, nevertheless, estimates are falling.

As a result, market participants often face the question not about whether the company is growing or falling, but how much it falls under general pressure, can the company go bankrupt if the business is unprofitable, the product is not unique, the market share and the size of the business are modest, will the company be able to survive the pressure, return the valuation and grow even more?

In such a situation, it is much more reliable for an investor to hold positions in companies, that is:

- initially not too overvalued, because the American market always has a certain revaluation as the most stable;

- fundamentally strong, growing, international, with a large market share, and a growing market, with a strong management team, and great potential for further growth.

We can confidently say that such strong companies, at the end of the cycle of decline and market reversal, will restore valuations faster than others and will also grow faster than others.

For an investor whose portfolio contains shares of fundamentally strong and undervalued companies, the main risk will be the need to stay in the position a little longer than originally planned. This will allow you to wait until the correction in the market is over, the general trend will change to an upward one, and fix a positive financial result.

Many experts believe that the economic recovery may begin next year. When assessing market prospects, we take into account the following factors:

- the dynamics of the decline in inflation in the United States with the ongoing cycle of growth of the key rate and their ratio;

- the volume of printed money supply in 2020-2021 and the rate of its burning;

- the state of the global economy as a whole;

- political tensions, etc.

We believe it is likely that the downward trend will be replaced by an upward one closer to the end of 2023, then from the end of 2023 to the beginning of 2024, private companies will resume IPOs, and even before the end of 2024, the markets will go up. The Fund continues to monitor the fundamental indicators and their dynamics, if the changes are significant, the forecasts may have to be adjusted.

At the moment, we assess the market as bearish, and assuming that the market decline will last for almost another year, we do not allow ourselves to acquire assets at inflated, in our opinion, estimates.

At the beginning of last year, the fund considered a number of investment goals. However, upon closer examination, all of them either have weak growth prospects or are much more expensive than their intrinsic value in the buyer’s market, and such an entry would not allow them to receive significant income in the future.

The Veligera Capital team continues to work on the choice of goals — 4 projects are in development, and new ideas are being worked out in addition, allowing you to earn objectively against the downward trend in the stock market. Among the relatively safe solutions that allow you to earn income in a falling market with an investment period of up to a year, we include fixed-yield instruments at a rate above inflation. As an example, it can be a short-term loan or parallel import with a transaction cycle of 3-6 months.